Understanding Market Breakouts

Market breakouts are pivotal events in the financial markets, representing moments when the price of an asset surpasses established support or resistance thresholds with increased trading volume. These breakouts can serve as critical opportunities for traders keen on leveraging substantial market moves. Such an approach is versatile, applicable to a variety of financial markets such as stocks, forex, and commodities, making it an essential tool in the trader’s arsenal.

Key Characteristics of Breakouts

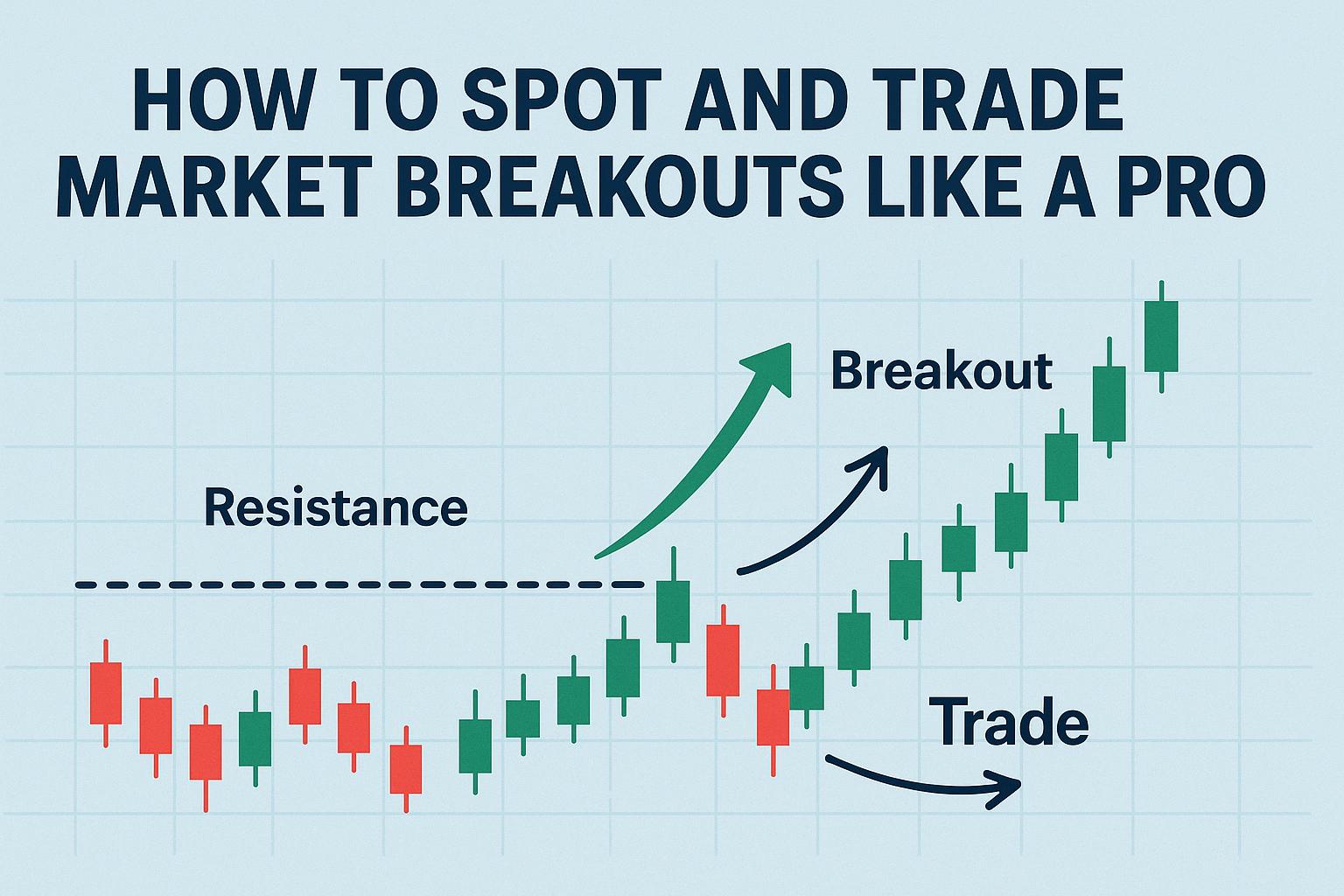

Breakouts typically reflect a shift in the balance of supply and demand, often leading to significant price movements. In essence, breakouts can be categorized into two distinct types: upside and downside breakouts. An upside breakout is characterized by the price moving above a resistance level, indicating a potential upward momentum. Conversely, a downside breakout occurs when the price drops below a support level, suggesting potential downward pressure.

For a breakout to be deemed credible, it is generally accompanied by an increase in trading volume. This uptick in volume implies a heightened level of participation from market traders, reinforcing the likelihood of a sustained movement in the direction of the breakout.

Technical Indicators for Breakouts

Traders often rely on various technical indicators to anticipate breakouts. Tools such as moving averages, Bollinger Bands, and the Relative Strength Index (RSI) are widely used to decipher potential breakout signals. These indicators assist in evaluating whether a particular price level is robust or poised for a breakout.

Strategies for Trading Breakouts

Pre-Trade Preparation

Preparation is key when engaging in breakout trading. Traders need to configure their charting platforms to track crucial indicators and potential breakout points accurately. Pinpointing support and resistance levels is a fundamental step, providing a framework upon which trading strategies can be constructed.

Entry Strategies

Deploying effective entry strategies is vital for successful breakout trading. One common approach is breakout confirmation, where traders await a confirmed breakout, indicated by a close above resistance or below support. Alternatively, anticipatory entries involve entering a trade prior to the breakout, potentially yielding higher returns but also bearing increased risk.

Managing Risks

Risk management is a cornerstone of profitable breakout trading. Traders should consistently apply stop-loss orders to curtail potential losses if the breakout does not hold. Additionally, appropriately sizing trade positions is crucial to safeguard against substantial financial losses.

Post-Breakout Evaluation

Monitoring Price Action

After a breakout occurs and a trade is initiated, vigilant monitoring of price action is essential. Observing how the price evolves can help confirm the validity of the breakout’s trajectory. Should the market exhibit signs of reversal or stagnation, it may be advisable to exit the position to preserve capital.

Utilizing Trailing Stops

Trailing stops are a strategic tool in securing profits during a favorable price movement. This mechanism dynamically adjusts the stop-loss level in reaction to the asset’s price changes, helping to lock in gains while permitting room for continued price advancements.

Conclusion

The ability to identify and trade market breakouts involves a detailed understanding of their characteristics, the application of technical indicators, and the execution of rigorous strategies. By integrating comprehensive preparation, strategic entry methods, and astute risk management, traders can enhance their prospects of profiting from market breakouts. For those seeking more detailed resources and trading methodologies, exploring platforms like Investopedia could offer valuable insights and further guidance.

This article was last updated on: October 25, 2025