Understanding Moving Averages in Day Trading

In day trading, moving averages are a widely-utilized tool by traders seeking to analyze price trends and behavioral patterns in the market. Essentially, they assist in smoothing out price data, which often experiences fluctuations, and create a single flowing line that enables traders to gain a clearer insight into the potential direction of a security’s price. This article delves into the fundamental concepts of applying moving averages within the realm of day trading.

Types of Moving Averages

In the diverse toolkit of traders, several types of moving averages are commonly employed, with the most prevalent being the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). It’s crucial for traders to comprehend these tools to deploy them effectively.

Simple Moving Average (SMA)

The Simple Moving Average is derived by averaging a predetermined number of past data points, rendering it a straightforward yet effective tool. For instance, a 10-day SMA would be calculated by summing up the closing prices over the last 10 days and then dividing by 10, giving an arithmetic mean price. This type of moving average aids traders in identifying possible new trends or reversals in the market. Its simplicity is beneficial, but it also means that it can sometimes underestimate sudden price shifts since it treats all data points equally.

Exponential Moving Average (EMA)

Unlike the SMA, the Exponential Moving Average assigns more weight to the most recent price data, making it more sensitive and responsive to new information in the marketplace. This characteristic of the EMA can enhance its effectiveness as an indicator, particularly for detecting abrupt changes in price trends that the SMA might overlook. Therefore, when traders are dealing with volatile assets where recent price movements are crucial, the EMA becomes a pivotal analytical tool.

Implementing Moving Averages in Day Trading Strategies

Traders can use moving averages in various day trading strategies, where they serve as valuable entry and exit signals, thus influencing decision-making processes significantly.

Trend Identification

A primary utility of moving averages is in identifying prevailing trends. When the security’s price remains above the moving average line, it traditionally indicates an upward trend or bullish sentiment, while a price situating itself below the moving average typically signals a downward trend or bearish market momentum. Recognizing these trends aids traders in aligning their strategies accordingly, possibly contributing to greater decision-making efficacy.

Crossovers

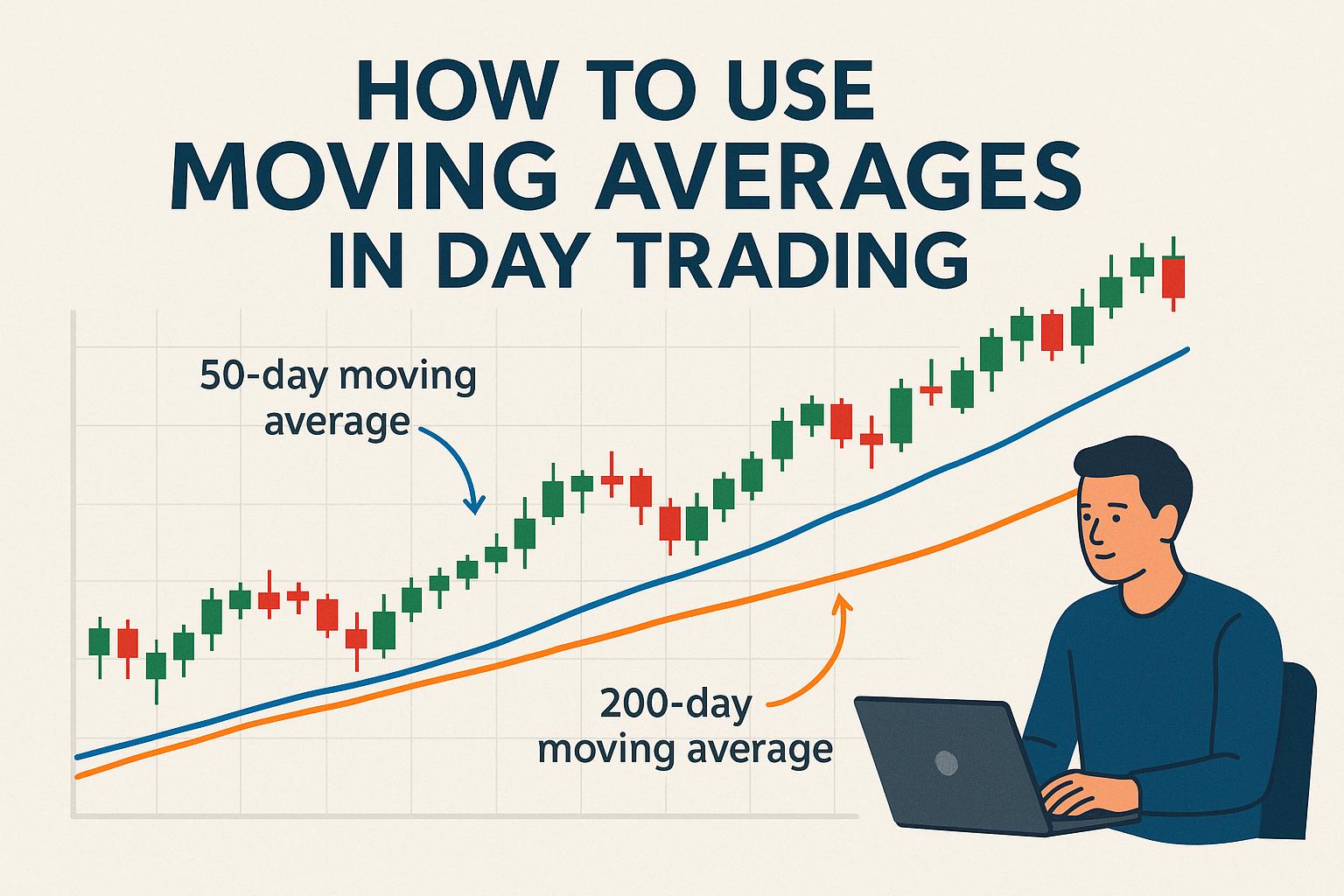

Crossovers present another compelling strategy involving moving averages. A crossover typically occurs when a short-term moving average intersects with a long-term moving average on the price chart. Professionals often implement the 50-day and 200-day moving averages for these purposes. A Golden Cross occurs when the 50-day average crosses above the 200-day average, often seen as a potential indication of a buying opportunity as it signifies a transition to upward momentum. Conversely, a Death Cross occurs when the 50-day average crosses below the 200-day average, suggesting a potential selling signal as momentum shifts downward.

Advantages and Limitations

The driving advantage of moving averages is their ability to simplify raw price data and help traders identify trends and price patterns, particularly advantageous in the fast-paced environment of day trading where rapid decisions are crucial. Nevertheless, it is important to recognize their limitations. Because moving averages are lagging indicators based on historical prices, they may not always reflect real-time market conditions and could be slow in reacting to swift market changes. Therefore, it’s advisable for traders to couple them with other analytical tools to form a more comprehensive understanding of market dynamics.

Moreover, the efficiency and reliability of moving averages can vary across different market conditions. In stable trending markets, they generally perform well. However, in volatile or sideways markets, they might produce misleading signals.

Conclusion

Moving averages remain a fundamental component of technical analysis, especially in the context of day trading. By thoroughly understanding their various forms and appropriate applications, traders can greatly enhance their capability to predict market movements and make informed trading decisions. It is recommended that traders continue to expand their knowledge by exploring detailed insights from established educational resources, such as Investopedia or other financial market education platforms, thereby fortifying their trading strategies. As the market environment evolves, the astute day trader must remain adaptable, continuously refining their use of moving averages and other technical indicators to sustain an edge in their trading endeavors.

This article was last updated on: October 30, 2025